To Disclose or Not to Disclose? That is the question.

You just want to sell! That means disclosing less is more right? Often, most sellers are conscientious about pointing out what their home that doesn’t work. But when it comes to the question about neighborhood noise or nuisances, they usually check “no” and move on to the next question. We can understand the hesitation about disclosing details because you fear – often with good cause – that it may make their home unsellable. Agents want the best for you and want your house to be as sellable as possible. Most importantly, we want you not to be stuck with any crazy lawsuits or legal fees you may incur based on what you do NOT say.

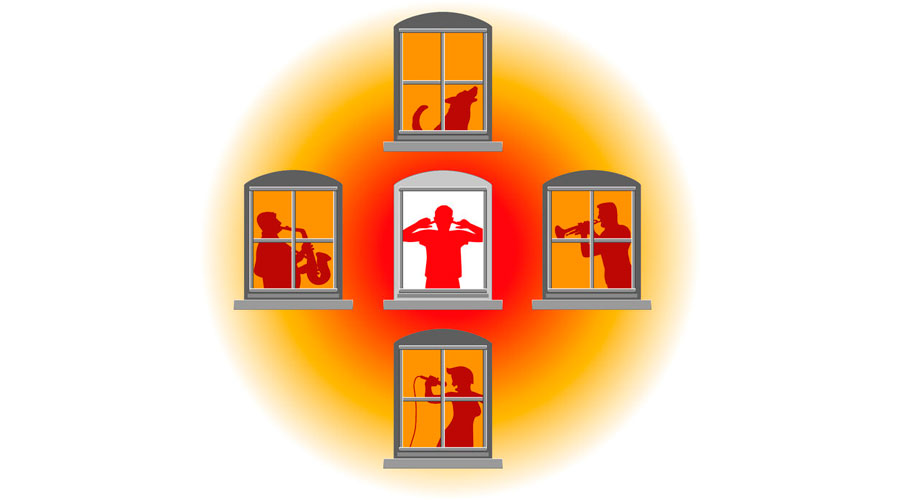

Did you know that noisy neighbors and or any annoying noise in the neighborhood might be something to disclose? Private nuisance is characterized as the unreasonable, unwarranted, or unlawful use of one’s property in a manner that substantially interferes with the enjoyment. It means when someone prevents or disturbs your use or enjoyment of your property. You may not notice or be considerably disrupted by people who love loud musical sounds, or the regular visit of raccoons, or the neighbors that don’t pick up after themselves, or let their pets run wild and bark 24/7. But your buyer may be quite bothered by these things and may come after you for not being upfront.

How about regular public nuisances? Yep, that too, especially California has astringent laws regarding this. A public nuisance can be anything that threatens the health, moral, safety, comfort, convenience, or welfare of the community. Some states would say that this could mean A meth house in the neighborhood, a bear that regularly visits and scares the children. A lot of regular traffic.

Each neighborhood may have the occasional few nuisances: The friendly neighbor who loves to use his leaf blower early Saturday morning, the occasional noisy repairs, the heavy metal band that practices in the garage down the street, the kids playing basketball. Most often nuisances are uncommon and unintentional. When they are continual issues, they need to be disclosed; your future buyers may feel that they diminish the enjoyment of the property as well as decrease its value.

Take away for sellers: The deal with disclosure laws is that they are very state-specific. What a seller must disclose in one state isn’t necessarily something that needs to be revealed in another. Make sure you check with the state in which you reside or are selling. The thing about disclosure is that you aren’t required to disclose what you don’t know, so sometimes looking too deep into the history of your home can be a bad thing. Be honest. Try to think of seller disclosures like a Carfax report.

A message to buyers: Be a little wary when there is no mention of neighborhood noise or nuisances. Perform your own investigation. One way is by visiting with the neighbors and asking some pointed questions about the neighborhood. Another is driving around the neighborhood at different times during the day and evening. But despite these efforts, a neighborhood nuisance is frequently beyond the capability of a buyer to discover.